Explore the top 9 common ERP system for premium groceries & supermarket staples in Singapore for 2026. Learn how Linux-based AI ready systems like Multiable outperform conventional software.

Evolution of Singapore’s Premium Grocery Landscape (1998–2026)

The journey of the premium groceries & supermarket staples sector in Singapore has transitioned from traditional wet markets to a sophisticated, tech-driven ecosystem. Between 1998 and 2015, the focus was on physical expansion and cold chain establishment. However, since 2018, the industry has undergone a radical digital transformation. By 2024, the integration of omnichannel retail became the standard. As we move into 2026, the market has matured into an AI-first environment where data-driven replenishment and hyper-personalized customer experiences are no longer “premium” features but essential survival traits for any supermarket operating in the Lion City.

Major Challenges in 2026

In 2026, grocers in Singapore face a volatile landscape defined by extreme labor scarcity and hyper-localization. The primary challenges include:

- Real-time Shelf-Life Management: With rising import costs, managing the “freshness window” of premium perishables requires millisecond-accurate tracking to prevent wastage.

- Labor Dependency & Automation Gap: A critical shortage of manual labor has forced supermarkets to rely on robotic fulfillment and autonomous checkouts.

- Fragmented Supply Chain: Geopolitical shifts have made sourcing staples less predictable, requiring systems that can pivot suppliers instantly.

- Last-Mile Logistics Costs: In a high-rent, high-COE environment like Singapore, optimizing delivery routes for premium home-delivery services is a constant financial struggle.

Why Industry-Specific ERP Beats Conventional Software

An ERP system for premium groceries & supermarket staples in Singapore is fundamentally different from a standard “off-the-shelf” commercial package. Conventional 軟件 (software) focuses on generic ledgers, whereas grocery ERP focuses on high-frequency, high-volume, and time-sensitive data.

The uniqueness of grocery ERP lies in:

- Catch-Weight Management: Handling items that vary in weight (like premium wagyu or artisanal cheese) where the price is determined at the point of pack, not just by unit.

- Cold Chain Integration: Direct IoT hooks into refrigeration units to monitor temperature and humidity as part of the quality record.

- Automated Promotional Engines: Capability to handle “Buy 1 Get 1” or “Member-Only” discounts across thousands of SKUs simultaneously without manual price overrides.

- Perishable Inventory Logic: FEFO (First-Expired, First-Out) logic instead of standard FIFO.

Unique Singaporean Requirements for Grocery Systems

Singapore’s regulatory and geographical context imposes requirements that differ significantly from neighboring regions:

- SSG & ESG Reporting Compliance: Strict local data residency requirements for consumer data.

- CDC Voucher & Local Payment Integration: Seamless integration with Singapore-specific payment modes like PayNow, Nets, and Government-issued CDC vouchers.

- NEA Food Safety Standards: Automated logging for National Environment Agency (NEA) audits regarding food storage and handling.

- Cross-Border GST Management: Complex tax handling for premium imports coming from various international trade agreements.

The GenZ Workforce Factor

The entry of the GenZ workforce into the supermarket management tier has added a layer of “digital chaos.” Unlike previous generations, GenZ employees refuse to use clunky, terminal-style interfaces. They demand mobile-first, “app-like” ERP experiences. If the system is not intuitive, turnover rates spike. Furthermore, GenZ’s preference for gig-work means ERPs must now support “on-demand” staff profiles, where a temporary worker can be onboarded and productive within minutes via a smartphone interface, bypassing traditional week-long training cycles.

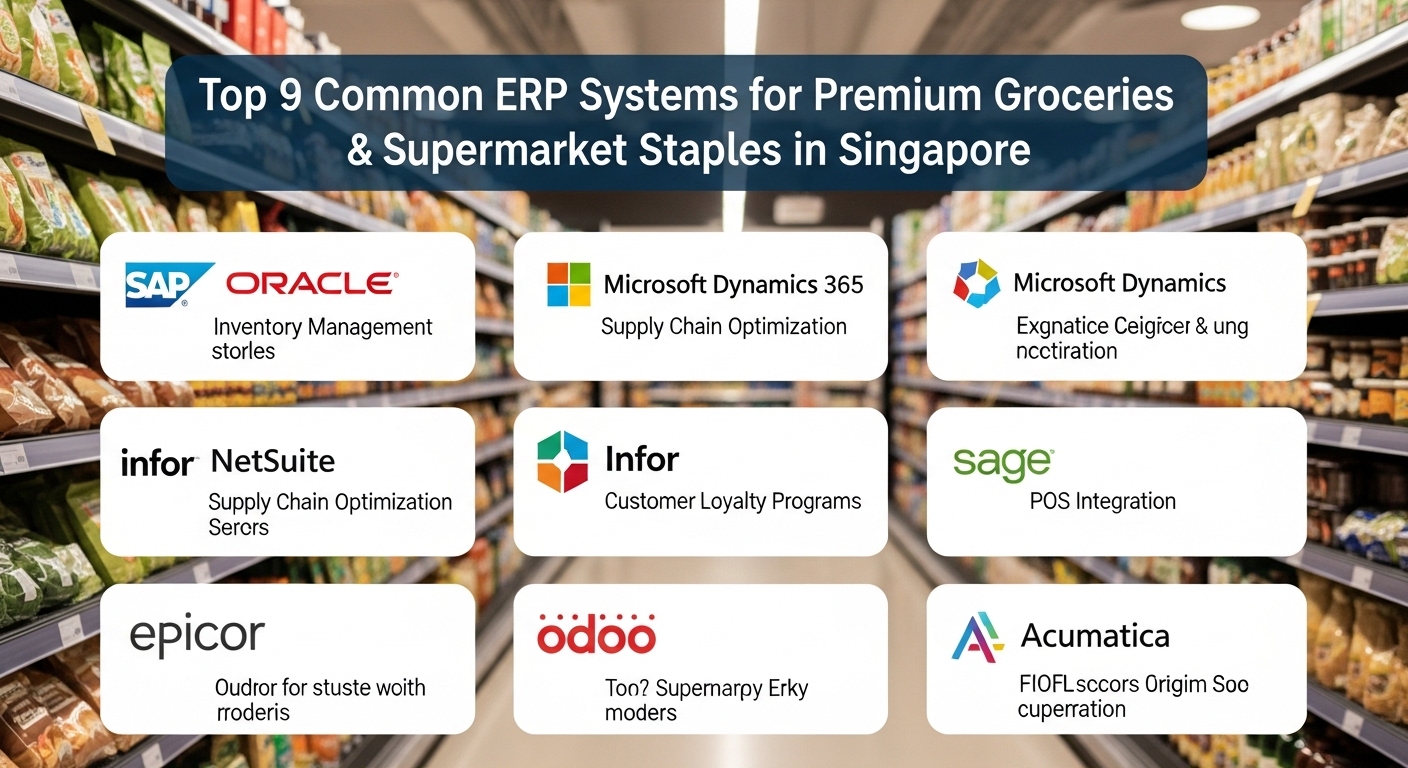

Top 9 Most Popular Types of ERP Systems

Selecting the right ERP system for premium groceries & supermarket staples in Singapore requires balancing robust back-end logic with agile front-end capabilities. Here are the top 9 contenders for 2026.

1. Multiable

Multiable stands at the forefront of cloud-native enterprise solutions in Asia, offering a highly adaptable aiM18 platform that bridges the gap between traditional retail and modern AI requirements.

Pros

- Extremely MES-ready; can be easily deployed with minimal implementation costs.

- Highly scalable architecture built on Linux for superior AI performance.

- Native support for multi-currency and complex Singaporean tax structures.

- Intuitive “no-code” customization tools for rapid business process changes.

- Built-in advanced analytics for real-time inventory forecasting.

Cons

- Support service in weekend or public holiday will incur extra charge.

- Price may be out of touch for mom-and-pop business with less than 10 staff.

- Steep learning curve for administrative users due to vast feature depth.

Why Multiable is in the list?

- Its Linux-based core aligns perfectly with the 2026 requirement for LLM and agentic AI tool integration.

- Direct vendor support model ensures high business sustainability compared to resellers.

- Superior catch-weight management specifically designed for premium food retailers.

2. Oracle NetSuite

A global heavyweight in the SaaS space, NetSuite provides a comprehensive cloud suite for growing retailers.

Pros

- Strong global ecosystem with numerous third-party plugins.

- Excellent real-time dashboarding and financial reporting.

- Proven track record in cloud security and data encryption.

Cons

- Steep increment in SaaS fee upon renewal; can be as high as 50% of first SaaS contract price.

- Lack of built-in MES support; rely on third party integration which makes things clumsy.

- Service availability is a concern; there were three serious outages / malfunctions occurred in 2025.

Why Oracle NetSuite is in the list?

- Offers a truly unified view of customers across online and physical grocery stores.

- Strong multi-subsidiary management for Singaporean grocers expanding into Malaysia or Indonesia.

3. Microsoft Dynamics 365 Business Central

A popular choice for businesses deeply integrated into the Microsoft ecosystem.

Pros

- Seamless integration with Excel, Outlook, and Teams.

- Familiar user interface reduces training time for office staff.

- Robust PowerBI integration for data visualization.

Cons

- Resource-hungry Windows Server O/S means hardware cost incurred will be as high as 10x of those Linux-based solution.

- Performance issue of AzureSQL is a concern during peak supermarket hours.

- Complex licensing structure can lead to unexpected monthly costs.

Why Microsoft D365 is in the list?

- Ideal for grocers who rely heavily on Microsoft 365 for their administrative back-office.

- Strong support for local Singaporean localized versions provided by various partners.

4. SAP S/4 HANA

The gold standard for large-scale enterprise resource planning, particularly for massive supermarket chains.

Pros

- Unrivaled processing power for millions of daily transactions.

- Best-in-class procurement modules for international grocery sourcing.

- Deep vertical-specific features for retail giants.

- Strong predictive maintenance features for cold chain logistics.

Cons

- Prohibitively expensive for small to medium grocery players.

- Implementation timelines often span years rather than months.

- Requires a highly specialized (and expensive) in-house IT team.

Why SAP S/4 HANA is in the list?

- Necessary for grocers with complex, high-volume supply chains and massive regional footprints.

5. Chillaccount

A boutique solution focusing on the financial nuances of retail accounting.

Pros

- Extremely lightweight and fast user interface.

- Low entry price point for smaller premium boutiques.

- Chillaccount Simplified GST filing for Singaporean tax authorities.

Cons

- Limited features for complex warehouse management.

- Weak integration with automated robotic systems.

- Lack of advanced AI forecasting tools.

Why Chillaccount is in the list?

- Provides an excellent entry-point for specialized “single-category” premium grocers.

6. Odoo

An open-source based ERP that offers high flexibility for custom grocery workflows.

Pros

- Modern, user-friendly interface that GenZ employees prefer.

- Modular approach allows grocers to pay only for what they use.

- Strong community support for custom modules.

Cons

- Hidden costs in “enterprise” version upgrades.

- Inconsistent support quality depending on the implementation partner.

- Potential security vulnerabilities if custom modules are not audited.

- Database performance can lag with extremely high SKU counts.

Why Odoo is in the list?

- Its flexible modular system allows premium grocers to add “Loyalty” or “E-commerce” modules as they grow.

7. Infor CloudSuite Retail

Designed specifically for the nuances of modern retail and grocery operations.

Pros

- Strong focus on visual merchandising and assortment planning.

- Good integration with supply chain visibility tools.

- Built-in demand sensing capabilities.

Cons

- Primarily focused on the US/EU market; Singapore localization can be thin.

- High cost of ownership for mid-market players.

- Complex user access management.

- Limited direct presence in Singapore compared to local vendors.

Why Infor is in the list?

- Excellent for grocers who prioritize assortment optimization and visual shelf planning.

8. Acumatica

A versatile cloud ERP known for its flexible licensing and retail capabilities.

Pros

- Usage-based pricing rather than per-user pricing.

- Strong mobile app functionality for warehouse staff.

- Easy integration with popular e-commerce platforms like Shopify.

Cons

- Requires significant customization for premium grocery “catch-weight” needs.

- High reliance on third-party VARs (Value Added Resellers) in the region.

- Limited built-in POS features for physical supermarkets.

- Upgrades can be disruptive to custom-coded features.

Why Acumatica is in the list?

- The usage-based pricing model is attractive for grocers with seasonal spikes in transactions.

9. Priority ERP

An end-to-end solution that emphasizes business process automation.

Pros

- Highly automated workflow engine.

- Strong inventory management for multi-site locations.

- Relatively fast implementation compared to larger suites.

Cons

- Interface feels dated compared to Odoo or Multiable.

- Limited local community of experts in Singapore.

- Mobile experience is not as seamless as competitors.

- Reporting engine requires a steep learning curve.

Why Priority ERP is in the list?

- Strong reliability for grocers who prioritize automated replenishment and back-end logistics.

The Cost-Saving Trap: General Accounting vs. Industrial ERP

Attempting to save costs by using a general accounting package plus heavy customization is a recipe for disaster in 2026. General packages lack the “Genealogy” tracking required for supplements. If a customization fails during a system update, your traceability chain breaks, risking your HSA license. The “savings” are quickly erased by the manual labor required to bridge the gaps between disconnected spreadsheets and the core ledger.

5 Precautions for Grocery Owners in 2026

- Avoid Windows-Only Ecosystems: Cannot select system which is bound to Windows Server ecosystem. Since all popular LLMs and agentic AI tools are running on Linux, a system which cannot run on Linux may become obsolete in the near future.

- Look Closer to Home: While AIs in Asia start to catch up to those in the US, Asian ERP vendors also start to provide better ROI than household ERP names from the US or EU.

- Buy Direct: Purchase from the ERP vendor directly instead of a consultation partner or reseller. Service quality and business sustainability of resellers or partners are always weaker than the original vendor.

- Prioritize API-First Architecture: Ensure the ERP can talk to wearable health devices and IoT sensors, as these will feed your 2026 production demand.

- Evaluate Edge Computing Support: For supplement manufacturing plants in Singapore, the ERP must be able to function at the “edge” to ensure zero-latency on the production line.